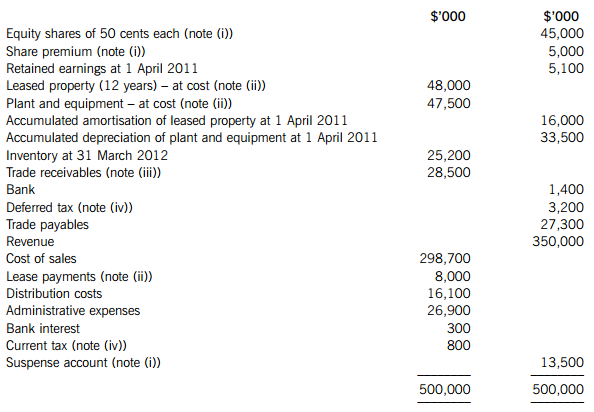

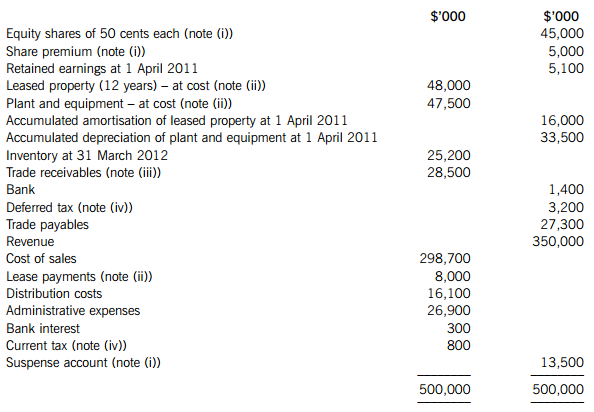

The following trial balance relates to Fresco at 31 March 2012:The following notes are rel

The following trial balance relates to Fresco at 31 March 2012:

The following notes are relevant:

(i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 2012. The terms of the share issue were one new share for every five held at a price of 75 cents each. The price of the company’s equity shares immediately before the issue was $1·20 each.

(ii) Non-current assets:

To reflect a marked increase in property prices, Fresco decided to revalue its leased property on 1 April 2011. The Directors accepted the report of an independent surveyor who valued the leased property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the leased property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation reserve. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability.

On 1 April 2011, Fresco acquired an item of plant under a finance lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 2011 and the first annual rental of $6 million paid on 31 March 2012. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. Had the plant not been leased it would have cost $25 million to purchase for cash.

Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2012. Depreciation and amortisation are charged to cost of sales.

(iii) In March 2012, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 2011 and the remainder to the current year. Fresco is not insured against this fraud.

(iv) Fresco’s income tax calculation for the year ended 31 March 2012 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2011. At 31 March 2012, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%.

Required:

(a) (i) Prepare the statement of comprehensive income for Fresco for the year ended 31 March 2012.

(ii) Prepare the statement of changes in equity for Fresco for the year ended 31 March 2012.

(iii) Prepare the statement of financial position of Fresco as at 31 March 2012.

The following mark allocation is provided as guidance for this requirement:

(i) 9 marks

(ii) 5 marks

(iii) 8 marks (22 marks)

(b) Calculate the basic earnings per share for Fresco for the year ended 31 March 2012. (3 marks)

Notes to the financial statements are not required.

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

答案

答案