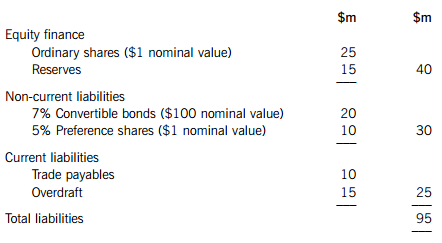

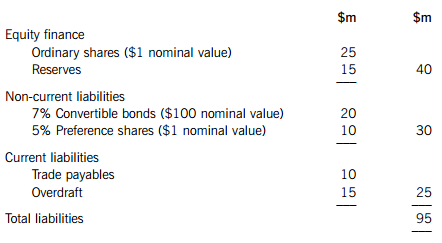

The statement of financial position of BKB Co provides the following information:BKB Co ha

The statement of financial position of BKB Co provides the following information:

BKB Co has an equity beta of 1·2 and the ex-dividend market value of the company’s equity is $125 million. The ex-interest market value of the convertible bonds is $21 million and the ex-dividend market value of the preference shares is $6·25 million.

The convertible bonds of BKB Co have a conversion ratio of 19 ordinary shares per bond. The conversion date and redemption date are both on the same date in five years’ time. The current ordinary share price of BKB Co is expected to increase by 4% per year for the foreseeable future.

The overdraft has a variable interest rate which is currently 6% per year and BKB Co expects this to increase in the near future. The overdraft has not changed in size over the last financial year, although one year ago the overdraft interest rate was 4% per year. The company’s bank will not allow the overdraft to increase from its current level.

The equity risk premium is 5% per year and the risk-free rate of return is 4% per year. BKB Co pays profit tax at an annual rate of 30% per year.

Required:

(a) Calculate the market value after-tax weighted average cost of capital of BKB Co, explaining clearly any assumptions you make. (12 marks)

(b) Discuss why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (4 marks)

(c) Comment on the interest rate risk faced by BKB Co and discuss briefly how this risk can be managed. (5 marks)

(d) Discuss the attractions to a company of convertible debt compared to a bank loan of a similar maturity as a source of finance. (4 marks)

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

答案

答案